The Vulnerable Japanese Bond Market

An analysis of the Japanese Government Bonds and Its Vulnerabilities

A market which was famously know as a “Safe Haven” and well known for its Stability and predictability has now transformed into a market with significant Vulnerabilities.

It’s the Japanese Bond Market which was the world’s third largest pillar in the Global fixed income environment, regarded as one of the safest sovereign debt instruments globally and one of the preferred destinations for investors and companies particularly at the times of global uncertainty.

A market with such a Goodwill has fallen into the trap of vulnerabilities because of many reasons. The very first is the Japanese Governments Debt to GDP ratio which stands at 234.9% and the nation’s debt which currently stands at $9 trillion which is double the size of the economy. This problem of debt was a long-standing issue which was driven by factors such as persistent fiscal deficit, an ageing population and social security spendings. However, this portion of debt was largely held by The Bank of Japan and other domestic institutions. This financial burden for over a long period represents a fragility within the market and challenging the notion of “Safe Haven”.

As there was a continuous increase in the financial burden the Bank of Japan retreated from its aggressive easing policies by which the market volatility surged, and the safety component begun to diminish.

The Vulnerabilities of the Japanese Government Bond Market

Deteriorating Demand and Auction Performance - The Japanese market has seen a series of weak auctions mainly in the case of long-term government bonds which was the weakest demand since 1987. The Bid to Cover ratio, a major indicator of investor appetite crashed down to 2.5 for the 20year bonds reflecting a lack of investor confidence.

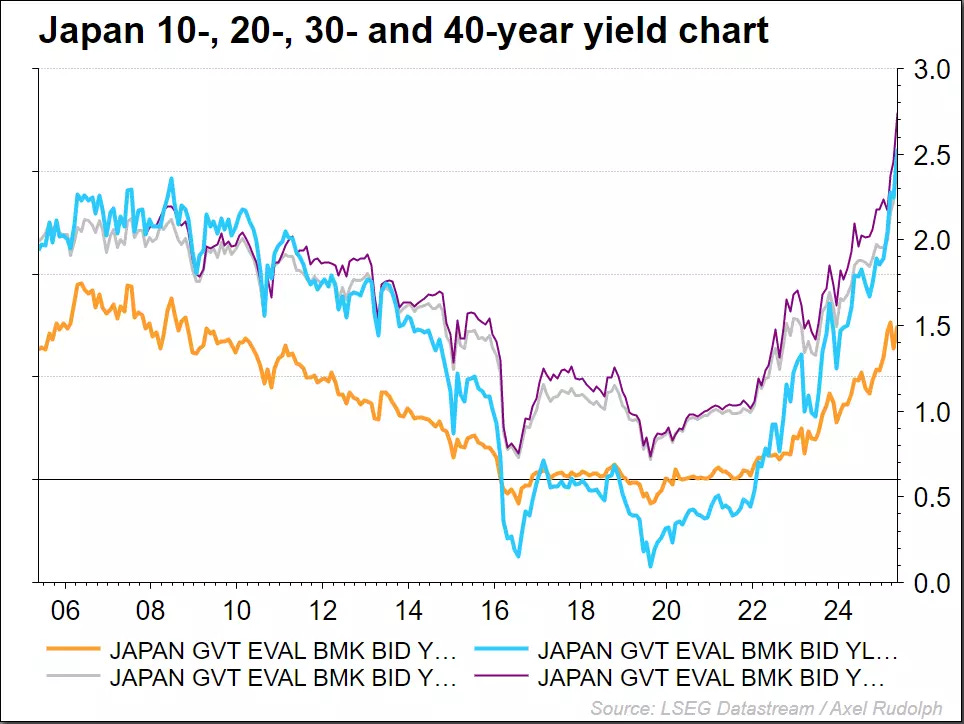

As a result of this there was a sharp rise in the yields across Japan’s long-term bonds which was a bad sign to the existing investors. The 20year and 30year bonds reached its highest yield since 1999, whereas the 40year bonds yield soared an all-time high of 3.689%.

BOJ’s Quantitative Tightening [QT]- The BOJ faced significant challenges in halting the reduction of its balance sheet, reinstating the Yield Curve Control (YCC) measures and even lowering its interest rates. But implication of any of these steps could result in an effect to the market both Domestically and Globally.

The central banks QT has so far trimmed the bond holdings only by 2.25%. The BOJ has caused significant challenges to the Domestic banks in absorbing the reduced Bond holdings. The rising yields are causing losses to the banks for which the financial institutions like Mitsubishi UFJ are shortening their JHB holding portfolio to 1.1 years.

Japan’s Fiscal Position and Debt Sustainability - The current debt burden for the Government is nearly $9 trillion which is double the size of Japan’s economy. PM Shigeru Ishiba states the Japan’s condition is “worse than Greece”. Though there is enormous financial burden the ruling party has been pressurized to borrow more debt ahead of the summer elections, in order to assist small businesses affected the US Tariff war and Inflation.

Now the BOJ plans to move away from negative interest rates, which increases the Government spendings. The increase in interest rates effects the Government in higher interest payments on National debt, which negatively impacts the GDP growth.

JGB Yield Curve Evaluation and It’s Dynamics

The 1year bonds currently yields at 0.58% which is an increase of 156.8% from the previous yield.

The 2year bonds currently yields at 0.76% which is an increase of 98.19% from the previous yield.

The 5year bonds currently yields at 1.01% which is an increase of 0.453% from the previous yield.

The 10year bonds currently yields at 1.52% which is an increase of 0.48% from the previous yield.

The 20year bonds currently yields at 2.36% which is an increase of 0.14% from the previous yield.

The 30year bonds currently yields at 2.89% which is an increase of 0.24% from the previous yield.

The 40year bonds currently yields at 3.09% which is an increase of 0.59% from the previous yield.

This steepening of the JGB yield curve is a direct and profound consequence of the BOJ’s retreat from the Yield curve control and its Bond purchases. This also indicates the willingness of Japan towards a normal market function but phasing through high volatility

Overall, the transition of JBG market from a safe haven to a volatile arena with deep seated vulnerabilities directly conflicts with the need for fiscal discipline. The implications of this market could be extended globally and possess a systematic risk, capable of Tightening global liquidity and impacting the prices of assets worldwide.